Taiwan’s economy might grow 3.8 percent this year amid robust external demand, but might only gain 1.7 percent next year, as key export drivers such as chips are losing steam, Moody’s Analytics said yesterday.

The Asia-Pacific region, including Taiwan, is outpacing most of the world’s economies with regional GDP growth expected to average 3.9 percent this year and 4 percent next year, faster than expected global GDP growth of 2.6 percent and 2.7 percent respectively, the research body said.

However, economic conditions within the region vary widely, it said.

Photo: Ritchie B. Tongo, EPA-EFE

Taiwan has enjoyed robust growth in exports thanks to the rise of artificial intelligence (AI), which has fueled demand for advanced semiconductors, it said.

Taiwan’s exports in the first eight months of this year expanded 10.9 percent year-on-year to US$308.57 billion, thanks to demand for electronics used in cloud-based data centers and the development of AI applications, government data showed.

The AI boom has not lifted Southeast Asia, which mainly produces low to mid-tier chips. Trade has played a key driver of growth for much of the region, but its impact has been uneven, Moody’s Analytics said.

Nevertheless, external demand in the region has been treading water due to slowing US growth and Europe’s stalled economy, it said.

Specifically, growth in global chip billings has decreased in the past few months, suggesting that shipments of tech products would decline, with no guarantee that domestic demand would offset the drop, Moody’s Analytics said.

At the same time, consumer prices are cooling in the region despite intermittent hiccups linked to bad weathers, it said, as is the case with Taiwan.

Moody's Analytics said that inflation is mostly in line with central bank targets even though risks are still skewed toward inflation overshooting rather than undershooting.

Food prices are jumpy and energy prices hover above pre-pandemic averages, it said, noting that a flare-up in commodity prices could stoke inflation and fuel monetary tightening.

Taiwan’s central bank last week left key policy rates intact, but hiked the required reserve ratio and stiffened lending terms to rein in the housing market, at odds with a rate cut by the US Federal Reserve to support the economy.

Meanwhile, elections in the US and Europe would further complicate the growth outlook, it said.

Potential shifts in US economic policy following the presidential election in November are a major concern, as US exports drive growth for much of the region, it said, adding that economies heavily dependent on strong US ties would be most affected.

The US has grown into Taiwan’s second-largest export destination due to a rapid increase in shipments of AI-related electronics.

Moody’s Analytics expects regional currencies to appreciate going forward after the US Federal Reserve cut interest rates by 50 basis points last week and its median projections suggest more cuts of 50 basis points toward the end of this year.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

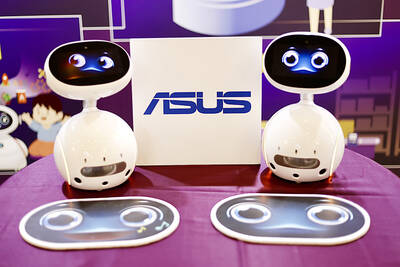

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would