A record number of exhibitors will this year attend Semicon Taiwan, an annual international trade fair in the semiconductor technology sector, when it opens on Wednesday next week in Taipei, organizer SEMI Taiwan said yesterday.

The annual event will feature more than 3,600 booths from over 1,100 exhibitors from home and abroad, the highest number since it was first held in 1996, according to SEMI Taiwan, an organization located in Hsinchu County that connects about 3,000 member companies and 1.5 million professionals worldwide to advance the technology and business of electronics design and manufacturing.

Ray Yang (楊瑞臨), an international strategy development consulting director at the government-sponsored Industrial Technology Research Institute (ITRI) and a committee member at SEMI Taiwan, said this year’s event has a theme of "Empowering AI Without Limits," and highlights the significance of silicon photonics and fan-out panel level packaging (FOPLP).

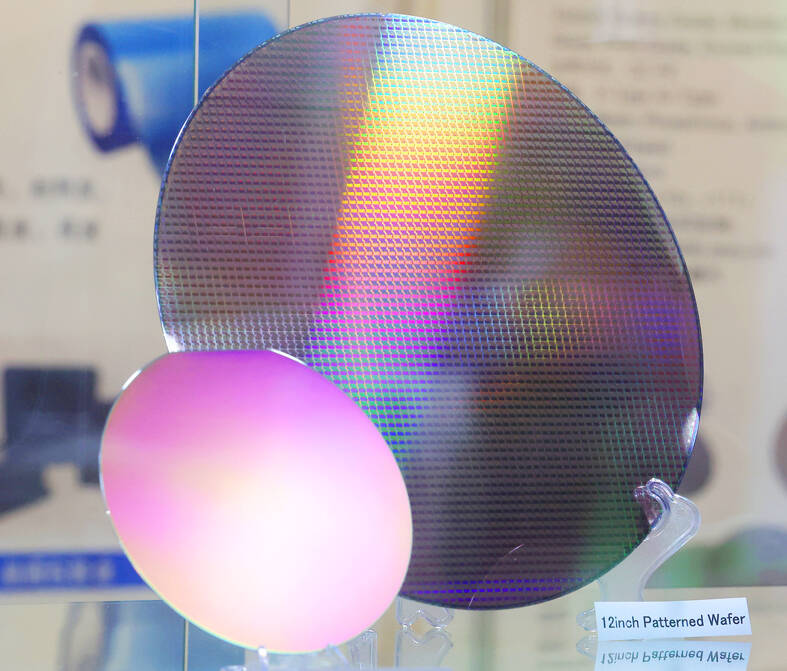

Photo: CNA

A forum focusing on silicon photonics will be held during the event, featuring experts from organizations and companies, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Inter-university Microelectronic Centre, and Marvell Technology Group Ltd, for discussions regarding the opportunities and challenges facing silicon photonics, Yang added.

Silicon photonics — known for its high bandwidth, low power consumption, long-distance transmission and cost-saving features — has become a hot topic in the semiconductor industry. It is estimated that the global silicon photonics market could reach US$7.86 billion by 2030.

In addition, a forum on FOPLP will also be held, with experts including those from Applied Materials Inc, Manz AG and Advanced Semiconductor Engineering Inc discussing and exploring related technological developments.

Driven by demand for 5G, artificial intelligence of things, automotive, high-performance computing and consumer products, FOPLP shows significant growth potential. According to research firm Yole Group, the market is expected to reach US$221 million by 2028, with a compound annual growth rate of 32.5 percent from last year to 2028.

Meanwhile, several TSMC senior managers, including executive vice president and co-chief operating officer YJ Mii (米玉傑), vice president of Pathfinding and Corporate Research Min Cao (曹敏), vice president of Advanced Packaging Technology and Service Jun He (何軍) and director of Advanced Packaging Business Development Jerry Tsou (鄒覺倫), will deliver speech at different forums during the event, Yang said.

He added that there will be 13 country sections at this year’s exhibition, with France, Malaysia and the Philippines new additions to the list.

Semicon Taiwan will take place from Wednesday to Friday at the Taipei Nangang Exhibition Center.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to