Taiwan’s official manufacturing purchasing managers’ index (PMI) last month rose to 55.4, rebounding to expansion mode for the first time in 14 months, as firms rebuild inventory amid subdued uncertainty, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday.

“The manufacturing industry reported business improvement in May, although uneven growth persisted,” CIER acting chairman Wang Jiann-chyuan (王健全) told a news conference in Taipei.

PMI data aim to gauge the health of the manufacturing industry, with values of 50 and higher suggesting expansion and scores lower than the neutral threshold suggesting a contraction.

Photo: CNA

It is the first expansion since May 2022 when Taiwanese manufacturers took a hit from a global slowdown induced by drastic inflation and monetary tightening.

The recovery came after the US and China put up decent economic showings with no new geopolitical tensions, Wang said.

That explained why the critical measures of new business orders and industrial output gained 13.7 and 10.9 points to 63.8 and 61 respectively, the monthly survey showed.

However, rush and short orders lingered, reflecting a conservative attitude among customers at home and abroad, Wang said.

Suppliers of electronics used in artificial intelligence products fared noticeably better than peers in other tech sectors, he said, adding that tech firms in general recover faster than non-tech companies, which remained weighed by weak demand and sharp competition.

The readings on inventory rose 2.1 points to 49.2, while customers’ inventory shed 1.8 points to 42.1, as they remained cautious, Wang said.

Sticky inflation in the US and the US Federal Reserve’s evasive stance on rate cuts lent support to that wariness, although firms grew more positive about their business prospects in the following months, the institute said.

The subindex on the six-month outlook rose 4.9 points to 60.1, its highest since April 2022, it said.

At the same time, the reading on raw material prices increased 2 points to 66.1, meaning that firms increasingly felt the pinch of price pressures.

The S&P Global Taiwan Manufacturing PMI, which was 50.9, arrived at a similar observation, finding that some manufacturers sought to protect their margin through a rise in output charges for the first time in five months.

The data on delivery time confirmed a recovery at 52.5, from 50.3 in April, as shipping container shortages and port congestions resurged due to conflict in the Red Sea, CIER said.

In related developments, nonmanufacturing companies also reported business improvements on the back of Mother’s Day celebrations, Wang said.

The nonmanufacturing index rose 0.1 points to 54.2, as service providers from almost all sectors registered positive cyclical movements, he said.

Nonmanufacturers reported positive views about their business, as evidenced by the six-month outlook, which rose 8.7 points to 63.6, the Taipei-based think tank said.

All sectors shared the optimism, thanks to the arrival of the high season for hospitality operators and TAIEX rallies that benefit financial service providers, it said.

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to

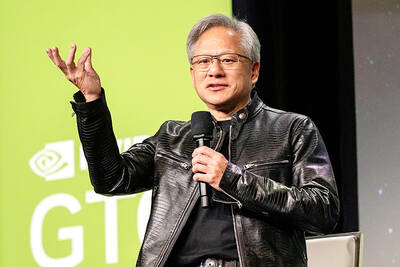

‘MAKE OR BREAK’: Nvidia shares remain down more than 9 percent, but investors are hoping CEO Jensen Huang’s speech can stave off fears that the sales boom is peaking Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day. The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines. The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to

NEXT GENERATION: The company also showcased automated machines, including a nursing robot called Nurabot, which is to enter service at a Taichung hospital this year Hon Hai Precision Industry Co (鴻海精密) expects server revenue to exceed its iPhone revenue within two years, with the possibility of achieving this goal as early as this year, chairman Young Liu (劉揚偉) said on Tuesday at Nvidia Corp’s annual technology conference in San Jose, California. AI would be the primary focus this year for the company, also known as Foxconn Technology Group (富士康科技集團), as rapidly advancing AI applications are driving up demand for AI servers, Liu said. The production and shipment of Nvidia’s GB200 chips and the anticipated launch of GB300 chips in the second half of the year would propel

State-run CPC Corp, Taiwan (CPC, 台灣中油) yesterday signed a letter of intent with Alaska Gasline Development Corp (AGDC), expressing an interest to buy liquefied natural gas (LNG) and invest in the latter’s Alaska LNG project, the Ministry of Economic Affairs said in a statement. Under the agreement, CPC is to participate in the project’s upstream gas investment to secure stable energy resources for Taiwan, the ministry said. The Alaska LNG project is jointly promoted by AGDC and major developer Glenfarne Group LLC, as Alaska plans to export up to 20 million tonnes of LNG annually from 2031. It involves constructing an 1,290km