Contract chipmaker Powerchip Semiconductor Manufacturing Corp (力積電) yesterday said revenue would gradually pick up in the second half of this year due to restocking demand and an optimized product portfolio in response to growing demand for artificial intelligence (AI) applications.

The Hsinchu-based chipmaker has been adjusting its product portfolios for the past two years with the aim of meeting demand from major customers, who were diversifying from China amid geopolitical risks, Powerchip president Brian Shieh (謝再居) told shareholders during the company’s annual general meeting in Hsinchu yesterday.

Powerchip is also developing a new process technology to make power management chips, vying for business opportunities in the Internet of Things (IoT), AI, high-performance computing and electric vehicle arenas, he said.

Photo: Grace Hung, Taipei Times

“With all those preparations and product line adjustments, we hope the effect will emerge from the second half to the first half of next year after customers reduce their inventory to normal levels,” Shieh said. “With capacity from the new fab in [Miaoli County’s] Tongluo Township (銅鑼) coming online in the second half, we anticipate the company’s revenue would gradually recover.”

Powerchip’s revenue fell 5.3 percent year-on-year to NT$14.5 billion (US$449 million) in the first four months of this year, following a 42 percent annual decline to NT$44 billion last year due to inventory adjustments.

Through product optimization, Powerchip is also looking to fend off rising competition from Chinese chipmakers, Shieh said.

China’s biggest chipmaker, Semiconductor Manufacturing International Corp (中芯), and Nexchip Semiconductor Corp (晶合) are major rivals to Powerchip.

Chinese companies expanded their capacity last year to produce display ICs, CMOS image sensors and power management chips using mature process technologies, but they had to drastically slash prices to compete for market share, Powerchip said.

Powerchip is also developing advanced “wafer-on-wafer” packaging technology as demand for devices such as PCs and smartphones with generative AI applications increases, Shieh said.

Powerchip plans to expand its product offerings to match customers’ demand for “single-level-cell” NAND and high-density NOR flash memory chips used in networking, mobile phones, IoT and computer peripherals, he said.

The company also plans to produce gallium nitride chips by rejuvenating its less-advanced 8-inch fabs, as well as power semiconductors including metal-oxide-semiconductor field-effect transistors and insulated gate bipolar transistors, he added.

Powerchip shareholders yesterday approved a proposal not to pay a cash dividend after the chipmaker lost NT$1.6 billion, or losses per share of NT$0.4, last year.

The company also booked NT$10.3 billion in idled manufacturing equipment losses and expenditures of NT$2.4 billion for the opening of the new fab in Tongluo Township.

The company last month said that it was approaching the break-even level last quarter as customers have reduced their inventory of chips used in consumer electronics such as smartphones, PCs and TVs to healthy levels.

Automotive and industrial chips were still in the process of inventory digestion, it said.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

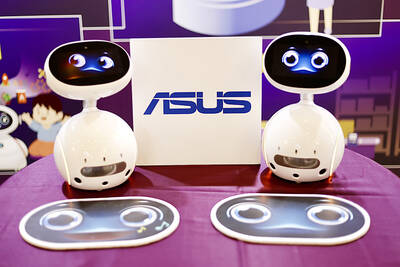

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would