The public’s confidence in the economic outlook and stock investment declined slightly this month, but remained positive overall, a survey by Cathay Financial Holding Co (國泰金控) showed yesterday.

Of the respondents, 34.2 percent expect the nation’s economy to improve in the next six months, while 32.1 percent are anticipating negative twists and 29 percent believe things would remain steady, the survey said after polling 16,543 customers online between May 1 and May 7.

That was a small retreat from last month, but stayed in optimistic territory, in line with the government’s business climate monitor system flashing “green,” which indicated steady economic growth, the conglomerate said.

Photo: CNA

The respondents are also upbeat about stock investment, although less optimistic compared with last month, after the TAIEX repeatedly hit record highs this month.

The survey also showed that 41.2 percent of respondents believe the TAIEX would climb higher moving forward, 26.8 percent anticipate corrections, 19 percent expect no changes and 13 percent said they do not know.

The local bourse has received fund inflows from foreign institutional players and mutual funds featuring quarterly or monthly distributions of cash dividends.

Taiwan’s exchange-traded fund market increased to NT$2.05 trillion (US$63.59 billion) as of Tuesday last week, posting an average 13.41 percent return for 60 funds this year, government data showed. The volume suggested a 40 percent spike from NT$1.46 trillion at the end of last year.

The impressive showings came at the cost of savings, such as insurance policies, which Taiwanese use to protect against retirement and old age.

Of the respondents, 34.4 percent said they would raise stakes in stock holdings, 14.9 percent intended to cut positions and 50.7 percent said they would maintain the status quo, the survey found.

Most people, 65 percent, said their income would stay the same in the coming six months, while 22.8 percent are looking at wealth gains and 12.2 percent at wealth erosions, the survey said.

When it comes to employment, 30.4 percent believe the job market would become more difficult going forward, compared with 19.8 percent who think finding jobs would become easier while 42.4 percent had neutral views, it added.

Despite the backdrop, 33.2 percent showed interest in purchasing big-ticket items, 21.7 percent said they would lower their budget and a relative majority, 45.1 percent, would not change their spending, it found.

Furthermore, a relative majority of 42.8 percent said that the need to declare personal income this month would not affect their funds or share holdings, the survey said.

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to

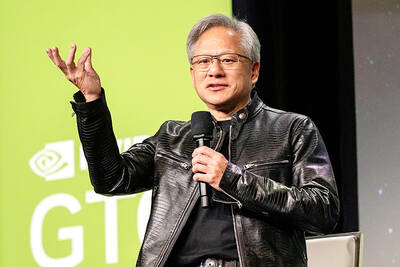

‘MAKE OR BREAK’: Nvidia shares remain down more than 9 percent, but investors are hoping CEO Jensen Huang’s speech can stave off fears that the sales boom is peaking Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day. The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines. The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to

NEXT GENERATION: The company also showcased automated machines, including a nursing robot called Nurabot, which is to enter service at a Taichung hospital this year Hon Hai Precision Industry Co (鴻海精密) expects server revenue to exceed its iPhone revenue within two years, with the possibility of achieving this goal as early as this year, chairman Young Liu (劉揚偉) said on Tuesday at Nvidia Corp’s annual technology conference in San Jose, California. AI would be the primary focus this year for the company, also known as Foxconn Technology Group (富士康科技集團), as rapidly advancing AI applications are driving up demand for AI servers, Liu said. The production and shipment of Nvidia’s GB200 chips and the anticipated launch of GB300 chips in the second half of the year would propel

The battle for artificial intelligence supremacy hinges on microchips, but the semiconductor sector that produces them has a dirty secret: It is a major source of chemicals linked to cancer and other health problems. Global chip sales surged more than 19 percent to about US$628 billion last year, according to the Semiconductor Industry Association, which forecasts double-digit growth again this year. That is adding urgency to reducing the effects of “forever chemicals” — which are also used to make firefighting foam, nonstick pans, raincoats and other everyday items — as are regulators in the US and Europe who are beginning to