Average monthly take-home pay in February increased 2.52 percent from a year earlier to NT$45,917, while total wages — which includes overtime pay, performance-based commissions and bonuses — soared 54.84 percent to NT$81,576 on the back of Lunar New Year bonuses, the Directorate-General of Budget, Accounting and Statistics (DGBAS) said yesterday.

Taiwanese firms on average issued Lunar New Year bonuses equivalent to 1.69 months of regular wages, or NT$77,348, the highest in nine years and up from 1.68 months a year earlier, Census Department Deputy Director Chen Hui-hsin (陳惠欣) said.

“The improvement came after service providers benefited from sustained revenge consumption in the post-COVID-19 pandemic era, although manufacturers took a hit from a global slowdown,” Chen told a news conference.

Photo: CNA

Financial and insurance companies offered the highest bonuses, averaging 3.64 months of wages, or NT$251,402, she said.

Manufacturers distributed 2.11 months of year-end bonuses, lower than the 2.14 months last year, she said, adding that suppliers of electronic components gave 2.76 months of bonuses, also weaker than 2.8 months a year earlier.

Exporters of tech and non-tech products had idle capacities and headcounts last year as they grappled with business declines induced by inventory adjustments and global inflation, Chen said.

Recreational facilities, hotels and restaurants fared better, issuing bonuses of 0.44 months to 0.74 months, compared with smaller bonuses or none last year, she said.

In the first two months of this year, regular take-home pay rose 2.39 percent annually to NT$46,017, while overall wages expanded 3.74 percent to NT$81,982, she said.

Real take-home wages after inflation remained in positive territory for the first time in two years with a 1.29 percent uptick as inflation pressure eased, Chen said.

The timing of the holiday also played a role, as local companies sometimes distribute year-end bonuses in December when the Lunar New Year is in January, she said.

Regular monthly wages have a fair chance of beating inflation due to the wage hikes and consumer price data, Chen said.

Holiday disruptions also explained why the number of workers hired in the industrial and service sectors in February shrank 0.25 percent, or about 21,000 people, compared with January, the DGBAS said.

Most firms halted operations for the holiday, it said.

As a result, the accession rate in February shed 0.07 percentage points to 2.04 percent, while the dropout rate gained 0.24 percentage points to 2.29 percent, it said.

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

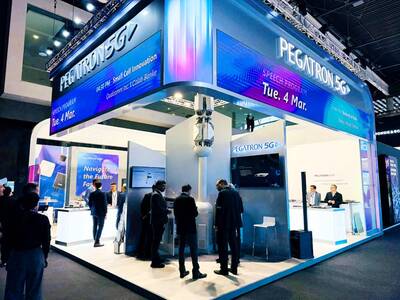

‘DECENT RESULTS’: The company said it is confident thanks to an improving world economy and uptakes in new wireless and AI technologies, despite US uncertainty Pegatron Corp (和碩) yesterday said it plans to build a new server manufacturing factory in the US this year to address US President Donald Trump’s new tariff policy. That would be the second server production base for Pegatron in addition to the existing facilities in Taoyuan, the iPhone assembler said. Servers are one of the new businesses Pegatron has explored in recent years to develop a more balanced product lineup. “We aim to provide our services from a location in the vicinity of our customers,” Pegatron president and chief executive officer Gary Cheng (鄭光治) told an online earnings conference yesterday. “We

LEAK SOURCE? There would be concern over the possibility of tech leaks if TSMC were to form a joint venture to operate Intel’s factories, an analyst said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday stayed mum after a report said that the chipmaker has pitched chip designers Nvidia Corp, Advanced Micro Devices Inc and Broadcom Inc about taking a stake in a joint venture to operate Intel Corp’s factories. Industry sources told the Central News Agency (CNA) that the possibility of TSMC proposing to operate Intel’s wafer fabs is low, as the Taiwanese chipmaker has always focused on its core business. There is also concern over possible technology leaks if TSMC were to form a joint venture to operate Intel’s factories, Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺)

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to