State-run Taiwan Cooperative Financial Holding Co (合庫金控) yesterday said that it is looking at stable profit growth this year, as the improving economy at home and abroad would benefit core businesses and reverse loss-making overseas operations.

The bank-focused conglomerate gave the guidance during an online investors’ conference and said that economic scenes appear less murky, limiting the need for provisions.

Taiwan’s GDP growth this year is predicted to rise more than 3 percent, much faster than last year’s 1.32 percent.

Photo: Chen Mei-ying, Taipei Times

Net income last year totaled NT$17.88 billion (US$558.92 million), or earnings of NT$1.17 per share, company data showed.

The results represented declines of 14.12 percent and 15.22 percent from their levels in 2022, mainly due to provision costs for operations in Cambodia and elsewhere, Taiwan Cooperative Financial president Chen Mei-tsu (陳美足) said.

“Cambodia emerged from the pandemic in a slower-than-expected fashion,” prompting the lender to raise provision costs in the second and third quarters of last year to shore up its capital strength, officials said.

Things started to stabilize in the fourth quarter, when overseas operations squeezed a tiny profit, they said.

A string of rate hikes by the US Federal Reserve also pushed up funding costs more rapidly than the rise in interest income, officials added.

That explains why its main subsidiary, Taiwan Cooperative Bank (合作金庫銀行), last year saw its net income fall 14.95 percent to NT$16.3 billion, despite trading gains from financial products — including foreign exchange swaps — soaring nearly 200 percent.

Foreign exchange swaps generated more than NT$9 billion in profit, but might drop to NT$7.5 billion this year, they said.

This is due to Taiwan’s central bank last week unexpectedly raising interest rates by 0.125 percentage points and given that the US Federal Reserve might lower rates to support the US economy, officials added.

The narrowing difference between the interest rates of Taiwan and the US is unfavorable for swap revenue, officials said.

Even without the provision costs, Taiwan Cooperative Financial would record a net income increase of almost 20 percent, indicating that core businesses remain healthy, Chen said.

High funding costs also affected the results of Taiwan Cooperative Securities Co Ltd (合庫證券) and Taiwan Cooperative Bills Finance Corp (合庫票券), officials said.

In contrast, its venture capital and life insurance units saw robust improvement in their earnings ability, they added.

Taiwan Cooperative Financial said it plans to distribute a cash dividend of NT$0.65 per share and another stock dividend of NT$0.35 from last year’s net income, suggesting a payout ratio of 85 percent.

The plan is still pending approval from a shareholders’ meeting later this year.

Anna Bhobho, a 31-year-old housewife from rural Zimbabwe, was once a silent observer in her home, excluded from financial and family decisionmaking in the deeply patriarchal society. Today, she is a driver of change in her village, thanks to an electric tricycle she owns. In many parts of rural sub-Saharan Africa, women have long been excluded from mainstream economic activities such as operating public transportation. However, three-wheelers powered by green energy are reversing that trend, offering financial opportunities and a newfound sense of importance. “My husband now looks up to me to take care of a large chunk of expenses,

State-run CPC Corp, Taiwan (CPC, 台灣中油) yesterday signed a letter of intent with Alaska Gasline Development Corp (AGDC), expressing an interest to buy liquefied natural gas (LNG) and invest in the latter’s Alaska LNG project, the Ministry of Economic Affairs said in a statement. Under the agreement, CPC is to participate in the project’s upstream gas investment to secure stable energy resources for Taiwan, the ministry said. The Alaska LNG project is jointly promoted by AGDC and major developer Glenfarne Group LLC, as Alaska plans to export up to 20 million tonnes of LNG annually from 2031. It involves constructing an 1,290km

NEXT GENERATION: The company also showcased automated machines, including a nursing robot called Nurabot, which is to enter service at a Taichung hospital this year Hon Hai Precision Industry Co (鴻海精密) expects server revenue to exceed its iPhone revenue within two years, with the possibility of achieving this goal as early as this year, chairman Young Liu (劉揚偉) said on Tuesday at Nvidia Corp’s annual technology conference in San Jose, California. AI would be the primary focus this year for the company, also known as Foxconn Technology Group (富士康科技集團), as rapidly advancing AI applications are driving up demand for AI servers, Liu said. The production and shipment of Nvidia’s GB200 chips and the anticipated launch of GB300 chips in the second half of the year would propel

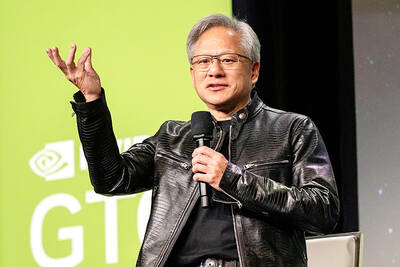

‘MAKE OR BREAK’: Nvidia shares remain down more than 9 percent, but investors are hoping CEO Jensen Huang’s speech can stave off fears that the sales boom is peaking Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day. The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines. The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to