Shares of Starlux Airlines Co (星宇航空) surged more than 53 percent on its debut on the Taiwan stock exchange yesterday.

Starlux shares closed up 53.75 percent at NT$30.75 from its initial public offering price of NT$20 after retreating in late trading from a 60 percent rise.

China Airlines Ltd (CAL, 中華航空) rose 0.90 percent to close at NT$22.35, while EVA Airways Corp (長榮航空) gained 0.40 percent to close at NT$37.70.

Photo: CNA

In Taiwan, a newly listed stock is allowed to go beyond the 10 percent maximum increase or decline in its first five trading sessions.

At the listing ceremony, Starlux chairman Chang Kuo-wei (張國煒) said the carrier has entered its second phase of expansion since last month, setting its sights on destinations in Europe.

Starlux is planning to add three destinations next year, covering long-haul and short-haul routes, Chang said.

The airline was looking to increase flights to Los Angeles and Seattle, and had also set its sights on other US destinations such as New York, Dallas and Houston, he said last month.

The carrier is expected to be operating 31 routes to 27 destinations worldwide by the end of this year.

Starlux has a fleet of 24 aircraft, which would increase to 26 after the carrier takes delivery of two A350-900s before the end of this year.

Chang said that the fleet is expected grow to more than 50 planes by 2026, focusing on aircraft geared for the long-haul market.

The next step would be to add more flights out of Taichung and Kaohsiung, he said, adding that the firm would likely add A320 aircraft, boosting the fleet to more than 70, to meet those needs.

Starlux was upbeat about the transit market through Taiwan for passenger and cargo business, he said, highlighting anticipated growth in demand for cargo services to destinations in Southeast Asia and the US.

The company is keen to enter the cargo business and early this year signed an agreement to buy five A350 cargo planes with an option for an additional five, he said.

Starlux was profitable for the first time last year, posting net profit of NT$149 million (US$4.65 million), or earnings per share (EPS) of NT$0.08.

In this first half of this year, its EPS was NT$0.39, up from NT$0.18 in the same period last year.

The airline reported consolidated sales of NT$9.60 billion last quarter, up 58 percent from a year earlier and the highest for any quarter in the company’s history.

To broaden its international reach, Starlux has said it would apply to join the Oneworld global airline alliance before the end of next year.

The Oneworld Alliance has 13 members, including American Airlines, British Airways, Cathay Pacific and Qantas.

It serves more than 900 destinations in 170 territories.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

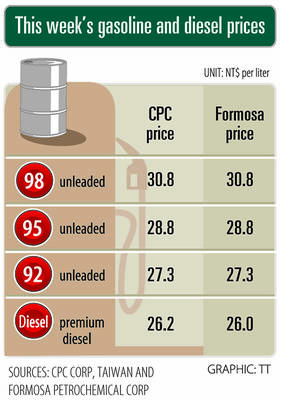

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the